UK government borrowing reaches record in first half of fiscal year

UK government borrowing reaches record in first half of fiscal year

UK government borrowing rose to the highest level on record in the first half of the fiscal year as the pandemic continued to undermine the country’s public finances.

In September, the UK central government cash requirement was £25.2bn, which was £10.4bn more than in the same month last year and the highest level in any September since 2008, according to the Office for National Statistics.

The September figure pushed the cash requirement in the first six months of the fiscal year, which began in April 2020, to £246bn, nearly three times the highest first-half figure since records began in 1984.

Despite the sharp rise, government borrowing in the first half was lower than what was forecast in July by the Office for Budget Responsibility, the fiscal watchdog, reflecting milder than expected falls in GDP and tax receipts.

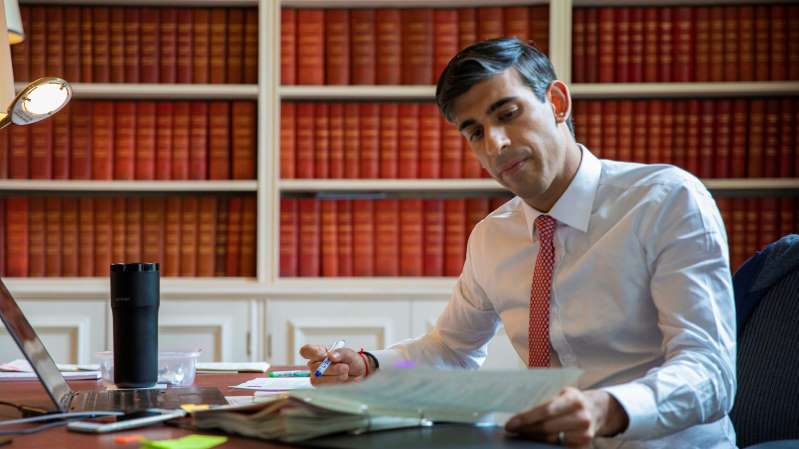

Rishi Sunak, chancellor, said that “whilst it’s clear that the coronavirus pandemic has had a significant impact on our public finances, things would have been far worse had we not acted in the way we did to protect millions of livelihoods”

.

.

Rising infections and tightening restrictions in many areas, including London, Wales and Greater Manchester, have damped hopes that the government’s extensive package to support the economy could be quickly scaled back, fuelling concerns over the UK’s mounting public debt.

In the first six months of the fiscal year, public net debt rose to 103.5 per cent of GDP, the highest level since 1960.

Central government tax receipts are estimated to have been £37.7bn in September, £6bn less than on the same month last year, with large falls in value added tax, business rates and corporation tax receipts.

In contrast, central government bodies are estimated to have spent £77.8bn on day-to-day activities in September, £18.1bn more than in the same month last year. This includes £4.9bn on the Coronavirus Job Retention Scheme and £1bn in Self Employment Income Support Scheme payments.

The ONS warned that estimates of public finances, such as public net debt, are subject to more uncertainty than usual as they are recorded on an accrued basis. Instead, the central government net cash requirement, the amount of cash needed immediately for the UK government to meet its obligations, is the “most timely information” on public finances and “less susceptible to revisions”, said the ONS.

Earlier in the month, the IMF forecast public debt to rise sharply in 2020 across most economies with the UK expected to register the second lowest debt-to-GDP ratio among the G7 countries after Germany.

Reference: Financial Times: Valentina Romei: